AR Foreign Currency Processing

This section describes how foreign currency transactions are processed by the StreamV Accounts Receivable System. It provides an overview of how foreign currency orders and invoices are created, how foreign currency payments and adjustments are processed, and how realized and unrealized exchange rate gains or losses are recorded in the system.

House Currency

StreamV supports a single “House Currency”. The House Currency is the currency that your company operates with. US dollars or USD would be the typical house currency used for a business operating in the United States, Australian dollars or AUD would be the typical house currency used for a business operating in Australia, The Euro or EUR would typically be used as the house currency for a company operating in the Euro Zone (Italy, Spain, Germany, etc).

The House Currency used by StreamV is specified at startup and should normally never be modified. Cove has converted some sites from obsolete currencies- like the Italian Lira, Spanish Peseta, Finnish Mark to the Euro, but this is not a normal occurrence and it requires special processing and expertise to accomplish.

The House Currency used by the System is stored in a System Policy record F248:HOUSECUR. This record stores the currency code that is associated with your House Currency (USD for US Dollars).

The StreamV General Ledger and other Accounting Systems use House Currency for reporting purposes. All General Ledger Transactions are booked in your house currency, and both house and foreign currency invoices are valued at their house currency amounts on reports such as the Accounts Receivable Aging.

Foreign Currency

A foreign currency transaction is any transaction that is processed using a currency other than you house currency. Foreign Currency Orders and Invoices store some amounts in foreign currency (the prices, commission cost, discount, sales tax, and shipping amounts) and some amounts in house currency (item cost information). An exchange rate is also stored in each foreign currency invoice, and this rate can be used to determine the house currency value of any foreign currency invoices in the system.

Currency Records

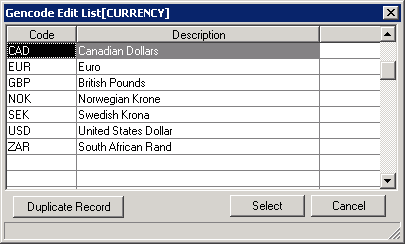

The different currencies that can be used in StreamV are defined using the Gencode Table CURRENCY

The CURRENCY table contains a record for each currency code that you wish to make available in the system. The currency codes can be a mazimum of 3 characters long. Each record in the currency table also contains a description field which can be used to provide a longer description for the currency.

StreamV requires at least one currency record – for the House Currency you wish to operate with. Other currency codes are optional.

The Currency records in the system are used to specify the currency to be used as a default by Master records (such as vendors, and customers), and the currency to be used for specific documents or transactions such as sales orders, purchase orders, and accounts receivable or accounts payable invoice and payment transactions.

A default currency (normally your house currency), is used during customer and vendor setup, and this default currency can be changed or not based on system security settings.

If a customer or vendor wishes to do business with you in a currency other than your house currency, and you have made the currency field available, the currency to be used for the customer or vendor can be set to the desired currency code (such as CAD for Canadian Dollars). This code will be used as the default currency for the customer or vendor when you process transactions for the company.

The ability to process transactions in a currency other than the customer or vendor default currency is based on system security settings, not the currency that is assigned to the company. The system allows you to process transactions in multiple different currencies for a single customer or vendor (a CAD customer on a system running USD as the house currency, can have CAD, USD, or other foreign currency orders, invoices and payments processed for them). Separate customer and vendor records are not required.

Exchange Rates

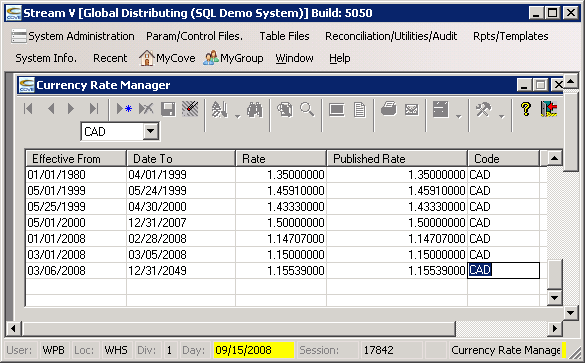

The system allows you to store currency rates for each currency that you use. The currency rate records are stored in the CURTABLE file. Each currency rate record consists of a published rate, an actual rate, and the date range that the rate is effective for. At least one currency rate must be entered into the system – for your house curency, and the rate in this currency rate record must be set to 1.0. The date range for this default currency rate record can be set to cover all dates that you may use (i.e. 01/01/1980 – 12/31/2049).

If you use currencies other than your house currency in the system, you will also need to create currency rate records for the other currencies you wish to use. Rate records for these foreign currency can be entered on a regular basis (daily, weekly, monthly) to allow the system to use current exchange rate information when processing transactions. New currency rate records are normally entered to handle exchange rate changes (vs modfiying the rate in existing records). This allows you to easily view exchange rate history.

Current Exchange Rate

The most current exchange rate for eaxh currency (based on the date in the currency table record ) is known as the current exchange rate. The current exchange rate is used by the system when creating sales orders, creating accounts receivable invoices, processing ar payment transactions and when running accounts receivable reports..

Historical Exchange Rate

As each accounts receiable invoice is created, the system stores the current exchange rate for the currency being used for the invoice in the document. The exxchange rate stored in the document is referred to as the historical exchange rate. The rate recorded in each documrent is not changed after the document is created – even when the current exchange rate for the currency is updated. This allows you to compare the house currency value of the invoice against the current value of the invoice (represented by the most current exchange rate for the invoice currency).

Realized Currency Gain or Loss

StreamV automatically records realized exhange rate gains or losses during payment processing. It does this by comparing the historical rate in the invoice being paid to the value of the payment being applied (the invoice is valued using the historical rate, and the payment is valued using the most current exchange rate for the currency being processed. If the exchange rate in the invoice and the current exchange rate being used for the payment are different, the system automatically records the exchange rate gain or loss that is realized when the payment is received.

Un-realized Currency Gain or Loss

The open AR Foreign Currency Invoices in StreamV are valued using the Historical Exchange rate stored in each invoice. When an Accounts Receivable Aging report is produced, any foreign currency invoice amounts are converted to house currency using the historical rate. The House or house currency value of all of the open AR Invoices should match the balance in your Accounts Receivable Control account in the General Ledger.

In some cases, you may wish to either determine or determine and record the amount of unrealized currency gain or loss for the open foreign currency invoices in your system. This unrealized gain or loss is the amount you would realize if the foreign currency invoices were all paid off using the most current exchange rate for each foreign currency.

To allow for this type of analysis and adjustment, the StreamV AR Aging reports produce a summary section for each currency – this section shows the total amount that is open for each currency and the value of the open invoices based on the most current exchange rate for the currency.

When the aging is run for a single foreign currency, the report provides you with

The amount of the open invoices in the invoice currency (this is reference information).

The value of the invoices based on the open invoice amount and the historical rate in each open invoice document (the house value of the invoices).

The value of the invoices based on the open invoice amount and the most current rate for the invoice currency (the value of the invoices based on the current excahnge rate for the invoice currency.

The amounts shown on the AR Aging can be used to book unrealized exchange rate gains or losses when required. Unrealized Exchange Rate Gains and Losses are not automatically posted by the system. If you wish to recognize the unrealized gain or loss for some reason (typically financial reporting purposes), the unrealized gain or loss is posted using a manual journal entry. The manual entry is normally reversed after the reporting period/

More:

AR Foreign Currency Processing

Overview

AR Foreign Currency Processing

Overview