Credit Request Lookup

The Credit Request Lookup displays the open Credit Requests in your system. The Credit Request Lookup can be used to display All open Credit Requests or the open Credit Requests for a single customer or a single invoice. The Credit Requests which are displayed in each situation is based on where the program is activated from.

The Credit Request Lookup allows you to

• View open Credit Requests

• Create a new Credit Request for a Customer or Invoice

• Remove an open Credit Request

The folllowing link can be used to view more information about Credit Requests.

AR Foreign Currency

Processing This section describes how foreign currency transactions

are processed by the StreamV Accounts Receivable System. It provides an

overview of how foreign currency orders and invoices are created, how foreign

currency payments and adjustments are processed, and how realized and unrealized

exchange rate gains or losses are recorded in the system. House Currency StreamV supports a single “House Currency”. The House

Currency is the currency that your company operates with. US dollars or

USD would be the typical house currency used for a business operating in

the United States, Australian dollars or AUD would be the typical house currency

used for a business operating in Australia, The Euro or EUR would typically be

used as the house currency for a company operating in the Euro Zone (Italy,

Spain, Germany, etc). The House Currency used by StreamV is specified at startup

and should normally never be modified. Cove has converted some sites from

obsolete currencies- like the Italian Lira, Spanish Peseta, Finnish Mark to the

Euro, but this is not a normal occurrence and it requires special processing and

expertise to accomplish. The House Currency used by the System is stored in a System

Policy record F248:HOUSECUR. This record stores the currency code that is

associated with your House Currency (USD for US Dollars). The StreamV General Ledger and other Accounting Systems use

House Currency for reporting purposes. All General Ledger Transactions are

booked in your house currency, and both house and foreign currency invoices are

valued at their house currency amounts on reports such as the Accounts

Receivable Aging. Foreign Currency A foreign currency transaction is any transaction that is

processed using a currency other than you house currency. Foreign Currency

Orders and Invoices store some amounts in foreign currency (the prices,

commission cost, discount, sales tax, and shipping amounts) and some amounts in

house currency (item cost information). An exchange rate is also stored in

each foreign currency invoice, and this rate can be used to determine the house

currency value of any foreign currency invoices in the system. Currency Records The different currencies that can be used in StreamV

are defined using the Gencode Table CURRENCY The CURRENCY table contains a record for each currency code

that you wish to make available in the system. The currency codes can be a

mazimum of 3 characters long. Each record in the currency table also

contains a description field which can be used to provide a longer description

for the currency. StreamV requires at least one currency record – for the

House Currency you wish to operate with. Other currency codes are

optional. The Currency records in the system are used to specify the

currency to be used as a default by Master records (such as vendors, and

customers), and the currency to be used for specific documents or transactions

such as sales orders, purchase orders, and accounts receivable or accounts

payable invoice and payment transactions. A default currency (normally your house currency), is used

during customer and vendor setup, and this default currency can be changed or

not based on system security settings. If a customer or vendor wishes to do business with you in a

currency other than your house currency, and you have made the currency field

available, the currency to be used for the customer or vendor can be set to the

desired currency code (such as CAD for Canadian Dollars). This code will

be used as the default currency for the customer or vendor when you process

transactions for the company. The ability to process transactions in a currency other

than the customer or vendor default currency is based on system security

settings, not the currency that is assigned to the company. The system

allows you to process transactions in multiple different currencies for a single

customer or vendor (a CAD customer on a system running USD as the house

currency, can have CAD, USD, or other foreign currency orders, invoices and

payments processed for them). Separate customer and vendor records are not

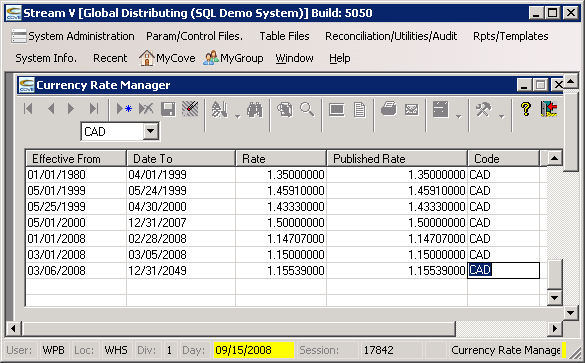

required. Exchange Rates The system allows you to store currency rates for each

currency that you use. The currency rate records are stored in the

CURTABLE file. Each currency rate record consists of a published rate, an

actual rate, and the date range that the rate is effective for. At least

one currency rate must be entered into the system – for your house curency, and

the rate in this currency rate record must be set to 1.0. The date range

for this default currency rate record can be set to cover all dates that you may

use (i.e. 01/01/1980 – 12/31/2049). If you use currencies other than your house currency in the

system, you will also need to create currency rate records for the other

currencies you wish to use. Rate records for these foreign currency can be

entered on a regular basis (daily, weekly, monthly) to allow the system to use

current exchange rate information when processing transactions. New

currency rate records are normally entered to handle exchange rate changes (vs

modfiying the rate in existing records). This allows you to easily view

exchange rate history. Current Exchange Rate The most current exchange rate for eaxh currency (based on

the date in the currency table record ) is known as the current exchange

rate. The current exchange rate is used by the system when creating sales

orders, creating accounts receivable invoices, processing ar payment

transactions and when running accounts receivable reports.. Historical Exchange Rate As each accounts receiable invoice is created, the system

stores the current exchange rate for the currency being used for the invoice in

the document. The exxchange rate stored in the document is referred to as

the historical exchange rate. The rate recorded in each documrent is not

changed after the document is created – even when the current exchange rate for

the currency is updated. This allows you to compare the house currency

value of the invoice against the current value of the invoice (represented by

the most current exchange rate for the invoice currency). Realized Currency Gain or Loss StreamV automatically records realized exhange rate gains

or losses during payment processing. It does this by comparing the

historical rate in the invoice being paid to the value of the payment being

applied (the invoice is valued using the historical rate, and the payment is

valued using the most current exchange rate for the currency being

processed. If the exchange rate in the invoice and the current exchange

rate being used for the payment are different, the system automatically records

the exchange rate gain or loss that is realized when the payment is

received. Unealized Currency Gain or Loss The open AR Foreign Currency Invoices in StreamV are valued

using the Historical Exhange rate stored in each invoice. When an Accounts

Receivable Aging report is produced, any foreign currency invoice amounts are

converted to house currency using the historical rate. The House or house

currency value of all of the open AR Invoices should match the balance in your

Accounts Receivable Control account in the General Ledger. In some cases, you may wish to either determine or

determine and record the amount of unrealized currency gain or loss for the open

foreign currency invoices in your system. This unrealized gain or loss is

the amount you would realize if the foreign currency invoices were all

paid off using the most current exchange rate for each foreign currency. To allow for this type of analysis and adjustment, the

StreamV AR Agings produce a summary section for each currency – this section

shows the total amount that is open for each currency and the value of the open

invoices based on the most current exchange rate for the currency. When the aging is run for a single foreign currency, the

report provides you with The amount of the open invoices in the invoice currency

(this is reference information). The value of the invoices based on the open invoice amount

and the historical rate in each open invoice document (the house value of the

invoices). The value of the invoices based on the open invoice amount

and the most current rate for the invoice currency (the value of the invoices

based on the current excahnge rate for the invoice currency. The amounts shown on the AR Aging can be used to book

unrealized exchange rate gains or losses when required. Unrealized

Exchange Rate Gains and Losses are not automatically posted by the system.

If you wish to recognize the unrealized gain or loss for some reason (typically

financial reporting purposes), the unrealized gain or loss is posted using

a manual journal entry. The manual entry is normally reversed after the

reporting period/ More:

AR Foreign Currency Processing Overview

AR Foreign Currency Processing Overview