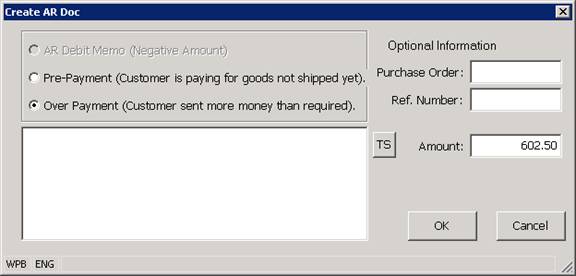

Create AR Doc

The Create AR Doc panel is used to create new AR invoice documents for overapplied or underapplied customer payments in the Cash Application program.

When a customer payment is being applied in the Cash Application program, the entire amount of the payment being processed must be applied to specific invoices for the customer, and the payment may not be saved until the To Apply Amount in the Cash Application program is zero.

In some cases, the customer payment being processed may not exactly match the amount of the open invoices for the customer, and a prepayment, overpayment or a debit memo invoice may need to be created for the customer. The prepayment, overpayment or debit memo invoice can be used to balance the current payment transaction and to track the over or underapplied customer payment amount.

Reasons that you may need to create a new document during cash application include:

• The customer is prepaying for items that have not been shipped out to them (the customer is on prepayment terms and you require the payment to be received before an order for the customer can be invoiced). In this case, a prepayment invoice is created to store the customer payment amount, and the order for the customer is released once the payment has cleared. The prepayment from the customer can be applied to the new invoice for the shipment once the shipment is completed.

• The customer is mistakenly paying for an invoice that has already been paid, or is paying the wrong amount. In this case, an overpayment invoice can be created to track and to describe the customer overpayment. The overpayment can be refunded to the customer or it can be applied to other open invoices for the customer at a later time.

• The customer is taking a deduction that you do not show on your books. In some cases, a customer may take a deduction for items that they have returned to you, or deduct an amount from a payment for other reasons (like freight, sales tax or price adjustments). In these cases, a debit memo invoice can be created in order to record the details for and track the amount being deducted by the customer. The debit memo allows you to apply the payment in the same manner requested by the customer, and still track the fact that an unauthorized deduction has been taken. The customer document, return number or other information for the deduction can be recorded in the debit memo or the comment that can be created for the debit memo.

When valid customer and payment information has been entered into the Cash Application program and the Create dm or pp Button is pressed, the system activates the Create AR Doc panel and it defaults the unapplied amount of the current customer payment being applied into the Amount field of the panel.

If the customer payment being processed has not been fully applied when the Create dm or pp Button is pressed, the system will display the unapplied payment amount as positive number in the Amount field and it will default the new invoice type to OP or overpayment. The invoice type can also be changed to PP (prepayment) when the to apply amount is positive.

If the customer payment being processed has been overaplied when the Create dm or pp Button is pressed, the system will display the overapplied payment amount as a negative number in the Amount field and it will default the new invoice type to DM (debit memo).

Once the Create AR Doc panel is displayed, you may create a new document by

• Selecting the invoice type for the new invoice. If the Amount field shown in the panel is positive, you may create an overpayment or a prepayment invoice (these invoices will have a negative balance when they are created). If the Amount field shown in the panel is negative, you may create a debit memo invoice in the program. The debit memo invoice will have a positive balance when it is created.

• Entering the optional PO or Ref No associated with the new invoice document. The PO and the Ref No fields can be used to locate the new invoice in the AR Invoice Lookups and during Cash Application.

• Verify or change the Amount for the new invoice. You may edit the amount shown in the Create AR Doc panel as required. You may also create more than one new invoice in the program if necessary.

• Enter an AR Comment for the new invoice. The AR Comments for each invoice can be displayed from the AR Invoice Lookup programs and they are also automatically output on the AR Aging. The AR Comment allows you to store a note that describes why the document was created, and any other relevant information about the transaction.

• Pressing the OK Button. When you have specified the information for the new invoice and press the OK button, the system creates a new temporary AR invoice document. This document will be assigned a permanent invoice number when the Cash Application transaction is saved. If you escape out of the Cash Application program before saving the transaction, any new invoice documents will be cleared, and no new invoices will be created.

Invoice Type Radio Buttons

The Invoice Type Radio Buttons allow you to specify the invoice type to be used for the new invoice. If the Amount field shown in the panel is positive, you may create an OP or PP invoice document. If the Amount field shown in the panel is negative, you may create a debit memo invoice document.

Optional Reference Information

Purchase Order: The Customer Purchase Order or PO associated with the new invoice

Ref. Number: The Reference Number associated with the new invoice. Invoices can be displayed and located using the Ref No field.

AR Comment

The Comment Section of the Create AR Doc panel can be used to enter an AR Comment for the new invoice document being created.

AR Comments are used by collections and accounts receivable personnel to track the reason that an invoice was created, or the reason that an invoice has not been paid. The AR Comments for each invoice can be displayed and edited from the lookups that display AR Invoice Detail, and the AR Comments for each invoice are normally output underneath the invoice when the invoice is included in an Accounts Receivable Aging.

You may enter a comment for the new invoice being created by keying in the appropriate comment information. When the new invoice document is saved, the system will create an AR Comment for the new invoice.

More:

Credit Request Lookup

Credit Request Lookup