POS Cash Payment Processing

This section describes how to process a Cash Payment and how to issue a cash refund using the POS program.

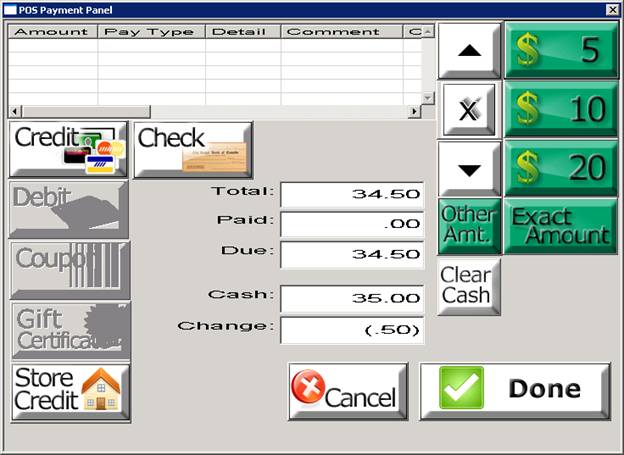

Once you have entered the items being sold to or returned by the customer and press the Pay Button in the POS program, the POS Payment Panel is displayed.

Entering the Cash being received or refunded

You may process a Cash Payment or Refund for a POS invoice or credit by using the Dollar amount Buttons or the “Other Amt”. “Exact Amount” and the “Clear Cash” Buttons in the POS Payment Panel. The amount of cash you enter is displayed in the Cash window in the panel.

• The Dollar Amount buttons ($5, $10, $20) can be used to quickly indicate the cash amount received from the customer, and the cash amount is increased each time one of the buttons is pressed (ie pressing $20 three times will cause the system to show $60 in the Cash window

• The “Other Amt.” button allows you to specify the exact amount of cash received from the customer. When this button is pressed, the system displays a numeric prompt object which allows you to enter the amount received. The amount can be typed direcly into the prompt or you may use the buttons in the prompt object to enter the appropriate amount.

• The “Exact Amount” Button will default the invoice total or the remaining balance for the transaction into the cash window when it is pressed.

• The “Clear Cash” Button clears out the cash amount displayed in the Cash window and it causes the system to recalculate the remaining amount due for the POS transaction.

Once the amount of cash being received (or paid out) is entered into the POS Payment Panel and any other payment amounts have been recorded, the Payment Panel will display the amount of change or the refund amount to be given to the customer in the Change Window.

If the amounts shown are correct, you may save the payment information using the “DONE” Button.

POS Cash Payment – Transaction Details

Once the Done button has been pressed in the POS Payment Panel, the system verifies all required information has been entered for the transaction. If so, the transaction is saved, if not, the system will display an error to indicate that the transaction cannot be processed.

As a POS transaction that includes a Cash Payment or refund is saved, the system performs the following steps.

• The POS invoice or credit memo (for a return) is created and posted to the general ledger (Sales, including POS Sales are normally posted to the GL on-line – but options also allow you to post sales by batch). The invoice or credit created by the POS system will reflect the payments or refunds that were processed in the POS program, and the invoice should have a 0 balance.

• An AR Payment or “check” record is created for the Cash Payment or refund. The AR Payment record is assigned a Type of “P” (POS Payment) and a Trancode of “PCS” (POS Cash). The AR Payment record is assigned a unique number that is based on the #ARTRAN counter, and it is assigned a unique comment number – so that notes can be attached to the record if required. The AR Payment record stores the name of the customer associated with the payment or refund, and the cash amount received or paid out. The AR Payment record is assigned to the POS Cash Clearing Account. The payment record is used to verify the daily deposit and paid out totals,and it is also used during AR Deposit processing.

• A Journal Entry is made for the Cash Payment or Refund. The journal entry lines are assigned a source of PS (POS), and a Code of PCS (POS Cash). The line that posts the payment to the POS Cash Clearing Account stores the unique #ARTRAN that was assigned to the AR Payment record in the Memo field of the JE line. The journal entry line that posts the payment to the AR Control Account stores the unique AR Payment number in the Memo field of the JE Line, and the invoice number that the payment was applied to in the Ref No field of the JE Line.

More:

POS Check Payment

Processing

POS Check Payment

Processing