Posting Payroll Entries

This procedure can be used to record payroll that is being processed in a third party system such as Quickbooks. This procedure records the Payroll expenses and liabilities that for the pay period and it reduces the Cash Account for the net amount of the paychecks which have been issued.

Once the journal entry described in this document has been made, Accounts Payable Invoices can be entered for the tax payments that should be made to any federal, state, or local authorities.

• Process the payroll in the third party system and print the reports that will be used to post the payroll transactions.

• Select the Journal Entry Program from menu.

• Check that the general ledger period, year and post date are set properly based on the payroll period being posted.

• Select the GL Accounts that the entry will be posted to.

• If this is the first time that you are posting a payroll entry, you will need to manually select the accounts that the journal entry will be posted to. You may select the accounts by pressing the INSERT key. This action will display the JE Line Editor. The JE Line Editor allows you to locate an existing GL account by account number or name. Once you have selected the correct account, you may enter the appropriate debit or credit amount for the account being posted to.

• If you have posted a payroll entry in the past, you may use the Recall JE Option to use a prior payroll entry as a template for the current entry. The Recall JE Option allows you to copy an existing journal entry to a new journal entry and to keep, zero or reverse the amounts of the original entry. When the Recall JE option is selected, the system prompts you for the journal entry number to be copied, and to define how the amounts should be handled. In most cases, it is easiest to zero the amounts from the prior entry. This automatically retrieves the proper GL accounts, and it allows you to manually key in and verify the amounts for the current entry. Note: The period, year and postdate for the new journal entry are based on what is specified in the Journal Entry program, not on the values in the original journal entry

• Use the Employee Earnings report and the Payroll Summary reports from the third party system to determine the amounts of each journal entry line. A Payroll Entry will normally be posted to Salary and Wages Accounts, Liability Accounts, Cash, and to Payroll Expense.

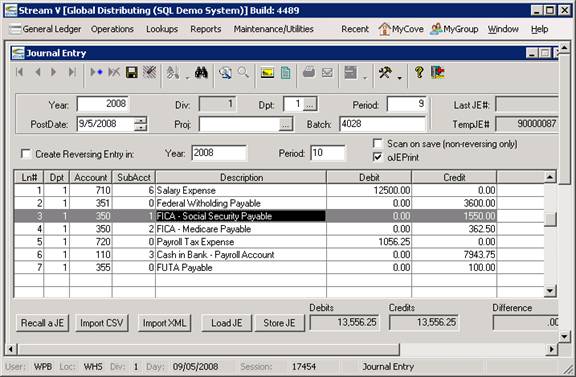

Typical accounts used for posting payroll, and the amounts that are posted to them are listed below.

• Salary Expense - Base Pay amount for salaried employees.

• Salary Vacation Expense – Vacation pay for salaried employees.

• Salary Bonus Expense - Premium Pay amount for salaried employees.

• Hourly Wage Expense - Base Pay amount for hourly employees.

• Hourly Bonus Expense - Premium Pay amount for hourly employees only.

All of above amounts should be debits and the total for the above four accounts should match the Total Gross Pay amount from the Payroll report.

• Federal Withholding Payable - Federal Income Tax amount withheld. The amount should be entered as a credit.

• State Withholding Payable - The State Income Tax amount withheld. The amount should be entered as a credit. (different GL accounts are normally used for each state if applicable).

• FICA - Social Security Payable - This is the total of the Federal Social Security taxes that are paid by the employer and the employees. The amount should be entered as a credit.

• FICA - Medicare Payable - This is the total of the Federal Social Medicare taxes that are paid by the employer and the employees. The amount should be entered as a credit.

• FUTA Payable – Federal Unemployment Tax. This amount would be entered as a credit.

• Payroll Taxes - This amount is the total of the Federal Social Security and Medicare Taxes paid by the employer, plus any Federal Unemployment tax paid by the employer. The amount should be entered as a debit

• Cash in Bank – The Net Total of the payroll checks issued. This amount is entered as a credit..

The following image shows an example of a payroll entry being processed.

More:

Viewing Account Activity

Viewing Account Activity