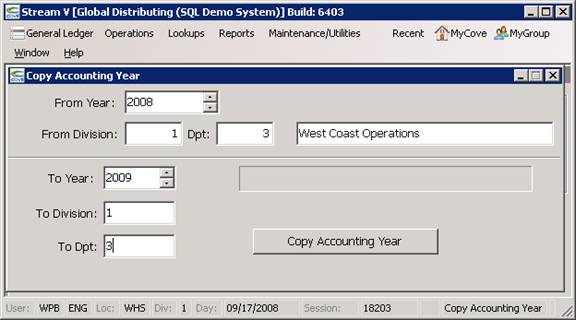

Copy Accounting Year

The Copy Accounting Year program

is used to create Account Period Records. Account Period Records must

exist for each general ledger account/sub account combination in each division,

department, year, and period in which you wish to post to the account.

The Copy Accounting Year program can be used to create Account Period Records (accpers) for a new year based on the accpers that existed in a prior year. The accpers may be created by division and or by department. The Copy Accounting Year program is typically used by companies who maintain multiple divisions and or departments in their general ledger, with different account structures maintained in the various divisions and departments.

An example of how the program might be used is as follows:

A company maintains 1 division and 4 departments in the general ledger.

All general ledger accounts for the company are maintained in division 1 and department 1, but only a limited number of income statement accounts are maintained in or posted to in department 2, 3, and 4.

If the current year (2004) Account Period Structure is set up correctly, the Account Period Records for the year 2005 could be created by running the Copy Accounting Year program 4 times as described below.

1.) Copy Year 2004, Division 1, Department 1 to Year 2005, Division 1, Department 1

2.) Copy Year 2004, Division 1, Department 2 to Year 2005, Division 1, Department 2

3.) Copy Year 2004, Division 1, Department 2 to Year 2005, Division 1, Department 3

4.) Copy Year 2004, Division 1, Department 2 to Year 2005, Division 1, Department 4

The above steps would result in the creation of an Account Period structure for the year 2005 that is identical to the structure that was used in 2004.

More:

Create Beginning Balances

Create Beginning Balances