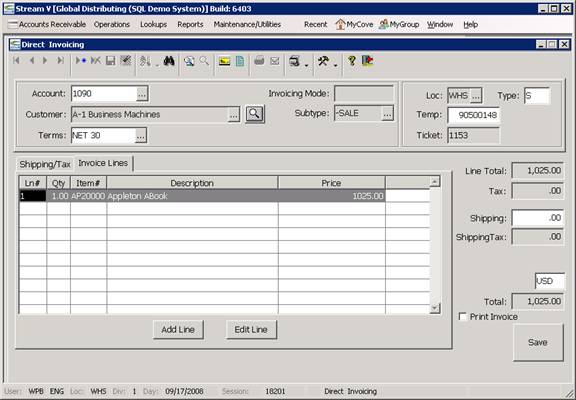

Direct Invoicing

The Direct Invoicing program allows you to create AR invoices that are not associated with a specific customer sales order.

The Direct Invoicing program can be used to quickly process invoices for

• Walk In Customers. The Direct Invoicing program allows you to invoice stocking inventory items that are on hand and that are available for sale (not already allocated to shop orders or customer sales orders). Stocking and Non-stocking, serialized and non-serialized items are supported.

• Shipping Adjustments. The Direct Invoicing program can be used to create invoices for customer freight adjustments. A nonstock inventory item like Freight Adjust can be entered as an invoice line and a positive or negative shipping amount can be entered into the program. The sales tax information in the invoice line (which defaults based on the Company and Shipto information being used for the invoice), is used to calculate any sales tax for the freight amount.

• Price Adjustments. The Direct Invoicing program can be used as part of a credit and rebill procedure to correct customer pricing errors. If an Order Invoice is issued for the customer, then credited (or partially credited) using the Credit Invoice option in the AR Lookup program (which reverses the original invoice or partially reverses it), the items can be rebilled to the customer (at the correct price) using the Direct Invoicing program. This only works when the items do not actually return to you and it requires the serial numbers (if any) for the items to be re-entered. This procedure will be streamlined in a new Price/Tax Adjustment program in a future release.

• Sales Tax Adjustments. The Direct Invoicing program can be used as part of a credit and rebill procedure to correct customer sales tax errors. If an Order Invoice is issued for the customer, then credited (or partially credited) using the Credit Invoice option in the AR Lookup program (which reverses the original invoice or partially reverses it), the items can be rebilled to the customer (using the correct sales tax information) using the Direct Invoicing program. This only works when the items do not actually return to you and it requires the serial numbers (if any) for the items to be re-entered. This procedure will be streamlined in a new Price/Tax Adjustment program in a future release.

• Other Nonstock items. Positive and negative amounts can be billed to or credited to customers using nonstock items. Rebates, Price Protection (given to customer) and other items can be handled using a combination of nonstock items and dedicated product line records.

• Credit Requests. Credit Requests are used by customer service to let accounting know about non-product related invoice adjustments. The Direct Invoicing program allows you to review Credit Requests and to convert them into credit memos.

Program Overview

The Direct Invoicing process basically involves;

• Selecting the Customer to be processed.

• Selecting the Ship to Address to be used for the invoice. A Will Call address can be selected, or a customer address can be used. Existing customer ship to addresses can be edited and new addresses can be entered during processing. The Ship to address should be selected before entering line items as you may not change it after lines have been created.

• Entering the Invoice Lines for the invoice. As each invoice line is entered, the system automatically calculates a default price based on the customer and inventory pricing information set up for the customer item combination. The price can also be edited. As each line is saved, the system checks item availability and allocates the appropriate bin quantity to the invoice. The system will not allow you to invoice a stocking item that is not available.

• Inputting Serialized Inventory information. If serialized items are entered on the invoice, the operator is prompted to select from the in stock serial records for the item or enter the appropriate number of serial numbers (if the item is serialized only when sold).

• Entering an optional shipping amount.

• Entering any required comments for the order. Invoice comments can be added to explain the reasons for any adjustment invoices.

The following links can be used to view a more detailed overview of the Direct Invoicing Process, and the actual procedure for creating a Direct Invoice.

Direct Invoicing Overview

Direct Invoicing Procedure

The Direct Invoicing program is divided into several different objects (windows, tab pages, prompt buttons). These objects are described in more detail in the following sections.

More:

Header Section

Header Section